[ad_1]

Delta Drone Worldwide Restricted (the “Firm”) (ASX: DLT) has entered right into a binding settlement with a consortium of traders* led by NASDAQ-listed Medigus Ltd and facilitated by Israeli enterprise capital agency L.I.A Pure Capital Ltd (collectively “Consumers”) to promote

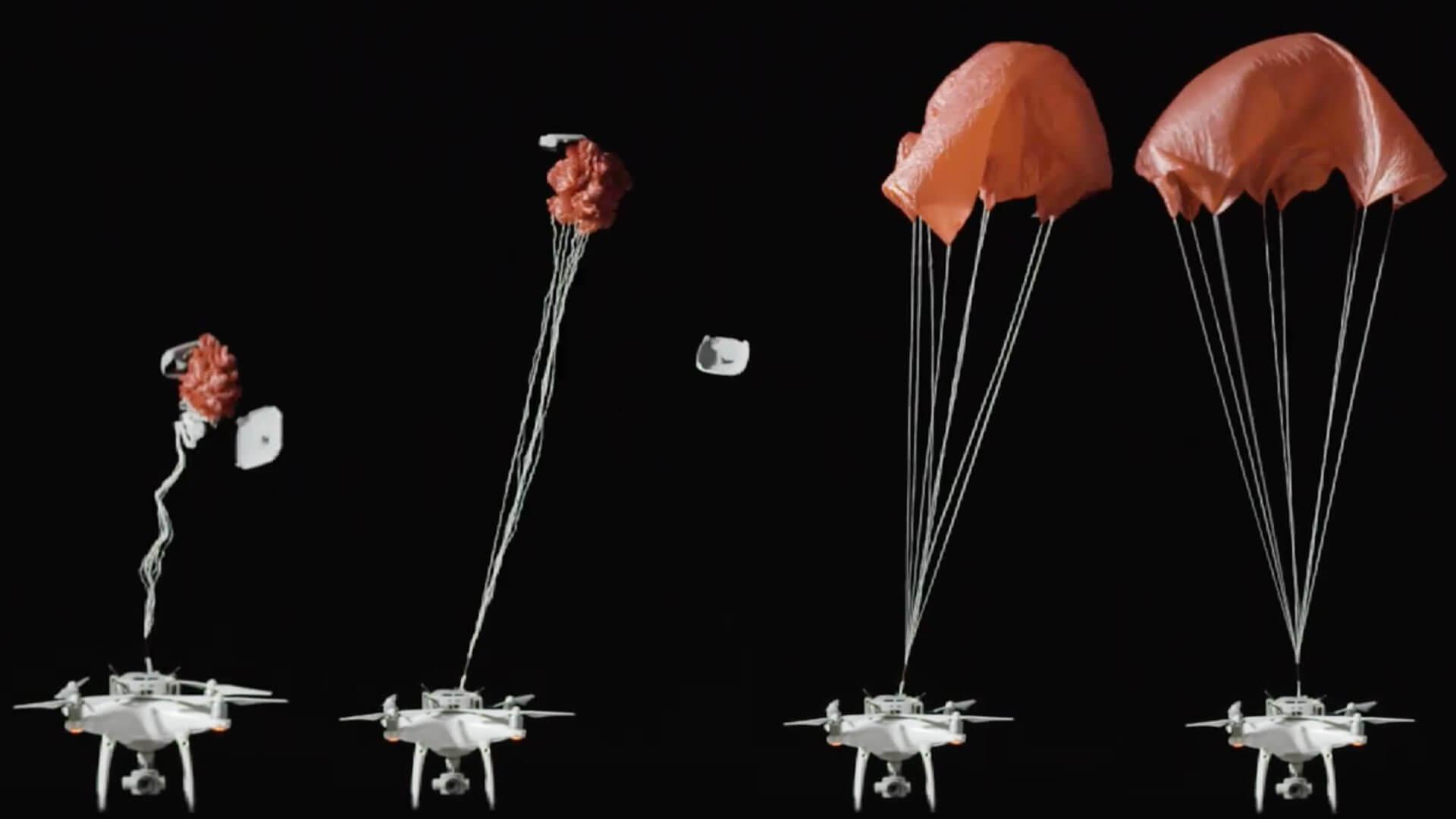

ParaZero Applied sciences Ltd (“ParaZero”) which operates the Firm’s drone security enterprise, for a complete consideration of A$6 million in money.

This transaction permits the Firm to deal with changing into one of many main drone service suppliers globally after its profitable acquisition of the Delta Drone South Africa enterprise in December 2020 and the acquisition of Arvista Pty Ltd in Australia in September 2021. Publish-sale this can depart the Firm with a strengthened stability sheet and a considerably lowered want for money to fund the continued R&D funding that had been required by the ParaZero enterprise, permitting the Firm to deal with aggressively rising its world drone companies enterprise.

Key phrases of the sale embrace:

• Buy value of A$6 million payable to the Firm in money, with $5.1 million to be

acquired on completion and $0.9 million to be launched from escrow after 12 months

(topic to there being no guarantee claims);

• The Firm to retain utilization rights in relation to using the expertise and

merchandise developed by ParaZero (see the Appendix for extra info); and

• The Firm to retain further fairness upside within the transaction worth from the difficulty

of Warrants to spend money on ParaZero once more sooner or later beneath sure circumstances

Because the Firm has sought and obtained affirmation from ASX that Itemizing Guidelines 11.1.2,

11.1.3 and 11.2 don’t apply to this transaction, there are not any regulatory circumstances that might stop completion of the transaction, which is anticipated to finish in January 2022.

Commenting on the sale, Delta Drone Worldwide CEO, Christopher Clark mentioned:

“ParaZero and its devoted group have been the inspiration for itemizing the Firm on the ASX in 2018 and have been an necessary a part of the Firm since that point. With the drone

companies facet of our enterprise experiencing fast progress, we imagine now could be the time to deal with the drone companies enterprise and nonetheless retain the chance to utilise the ParaZero services on a business foundation. The publicity to ParaZero that we’ve got retained via the transaction can even allow the Firm’s shareholders to profit from the longer term success of the ParaZero expertise.”

“For the Firm, this sale permits us to spend money on constructing our group and to aggressively

speed up progress throughout all our drone companies companies, with the imaginative and prescient of changing into one of many main drone service suppliers on this planet.”

“We need to thank the entire ParaZero group for his or her efforts over the previous couple of years as they’ve delivered on their imaginative and prescient to develop world-leading expertise for the secure use of drones in business functions.”

The sale shouldn’t be topic to any regulatory circumstances and is anticipated to finish as soon as residual circumstances have been met that are anticipated to be finalised within the coming weeks.

The Consumers have already paid their respective proportions of the completion cost into an escrow account for additional certainty of funding pending completion.

The proceeds from the sale will considerably strengthen the Firm’s stability sheet with

roughly $5.1 million in money being accessible at completion (much less the web debt in ParaZero being assumed by the Consumers and transaction prices, which collectively shall be roughly $0.45 million) and an additional $0.9 million which shall be accessible 12 months from completion (topic to there being no future guarantee claims). These funds will enable the Firm to spend money on constructing its group, notably in its gross sales, advertising and marketing and repair areas in order that it will probably ship its main drone companies to extra clients within the mining and agriculture industries, the place it’s seeing important progress alternatives.

Extra particularly, the funds acquired shall be retained by the Firm and used to satisfy each its current monetary obligations and to pursue alternatives for funding in new drone-based software program & geospatial data-related applied sciences which can be extra immediately associated to its ongoing service choices inside the Australian and African markets. The Firm additionally intends to pursue additional acquisition alternatives that may enable it to enhance its present companies with new technical capabilities or to increase into new geographic areas.

There shall be no modifications to the board or senior administration of the Firm because of

the transaction. The Firm intends to supply an replace on its total capital and

administration planning as a part of its monetary 12 months outcomes announcement in February 2022.

This announcement has been authorised for launch by the Board of Delta Drone Worldwide Restricted.

[ad_2]